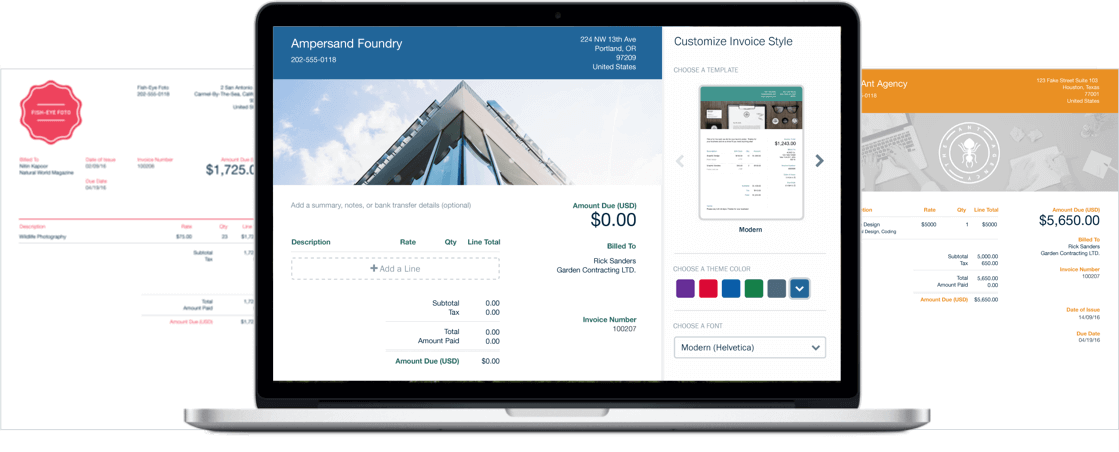

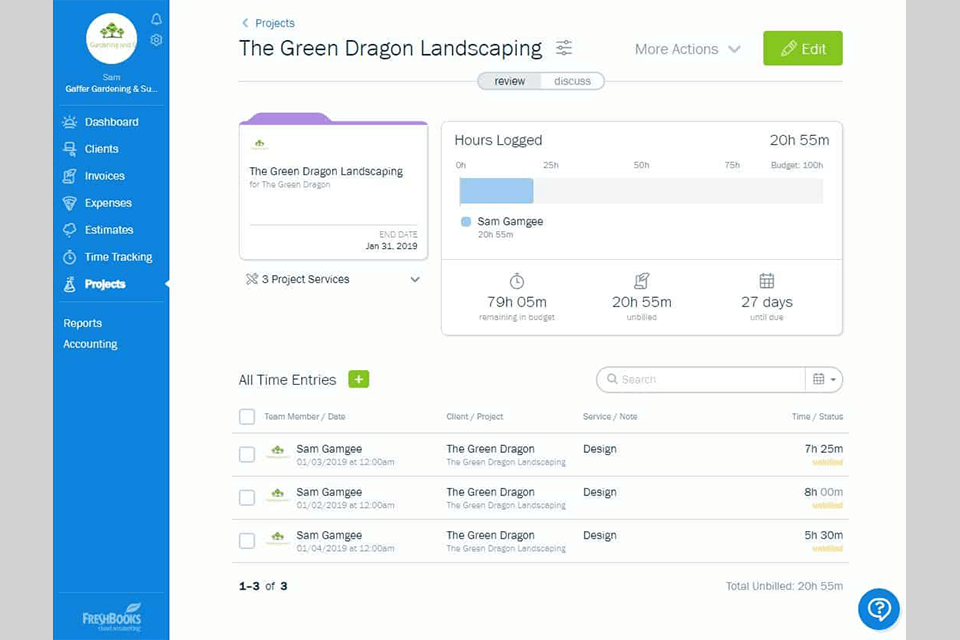

Improve communications between your teams and your vendors through collaboration. Personalize and automate your invoices, so you don’t miss a payment. With Freshbooks, it is very easy to integrate into your business platform. Freelancers who want to give off more of that “professional” look to their business will also benefit greatly from how quick and simple it’s done on Freshbooks. Freshbooks is perfect for small businesses that want to take on bigger and more complex invoicing tasks. Melio seamlessly syncs with QuickBooks and supports payment with any credit card or bank in the US.įreshBooks is one of the leading invoicing software solutions available in the market with around 5 million businesses maximizing its capabilities. Security features also include fraud detection, duplicate payment alerts, and payment approval workflows. These include ACH processing, debit/credit card payments, and check processing. Melio includes the essential features you would expect from a modern invoicing platform. This makes it an excellent solution for business owners who need reliable invoicing software but cannot opt for solutions with monthly recurring fees.

Best invoicing software wisesmallbusiness free#

What’s more, the platform is free to use and can be accessed online from any digital device like a tablet or smartphone. Melio is an easy-to-use invoicing software that’s suitable for small and medium businesses looking for a way to efficiently manage their accounts payable without complicated system setups and features. We urge you to take a look and see what we were able to gather, and hopefully, we’d be able to help you out in finding the right ‘shoe’ to fit and try on. So, to help you out, our team of highly qualified B2B experts and reviewers gathered the best invoicing software solutions currently in the market to give you the 10 best invoicing software solutions in the market for you to check out. After all, these are just as much an investment as other software solutions or business equipment. But before you do, you should make an educated decision when implementing such a solution in your company. That said, it might be best that you do the same to optimize your operations. This shift is seen to result in the expansion of the global e-invoice market. However, this is not an entirely new development as an Association of Financial Professionals 2019 report has revealed that only 42% of B2B payments were made using checks. With businesses realizing the benefits of invoicing software, many have transitioned to using the technology, moving away from using checks for B2B payments. Aside from this, one in four companies has also moved to electronic invoicing in 2020.

A study conducted by Mastercard has revealed that 50% of businesses in North America have added digital collection systems. The COVID-19 pandemic had companies favoring the use of e-invoicing systems, which carry with them digital payment options like ACH bank transfers and credit cards.

0 kommentar(er)

0 kommentar(er)